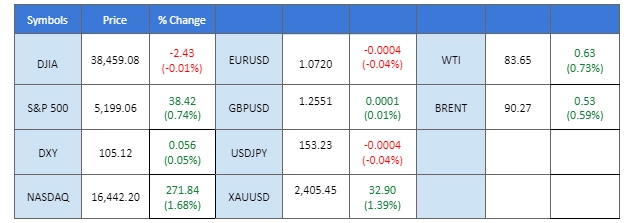

Gold prices surged to near-record highs, driven by a subdued US Producer Prices Index, fueling expectations of Federal Reserve rate cuts and bolstering gold’s appeal as a safe-haven asset amidst escalating geopolitical tensions, notably between Israel and Iran. Meanwhile, the US Dollar initially stumbled following lower-than-expected PPI data but rebounded as bullish job reports alleviated concerns. Crude oil prices maintained upward momentum amidst Middle East tensions, with Iran’s retaliation threats supporting prices despite tempered gains due to economic uncertainties. Conversely, the Euro faced significant downward pressure as the European Central Bank hinted at a possible interest rate cut in June to combat stagnant economic growth, signalling a dovish stance from policymakers.

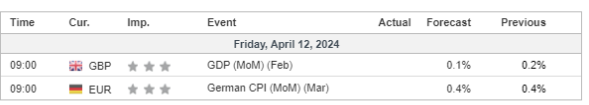

Current rate hike bets on 1st May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (97%) VS -25 bps (3%)

(MT4 System Time)

Source: MQL5

Initially faltering after the release of a lower-than-expected US Producer Price Index (PPI), the US Dollar rebounded amidst uncertainties surrounding interest rates. Despite the PPI slipping from 0.60% to 0.20%, indicating subdued changes in manufacturer prices and mitigating inflation risks, the Dollar’s losses were tempered by a bullish jobs report. US Initial Jobless Claims performed better than expected at 211K, surpassing market forecasts of 216K, providing support to the Dollar’s recovery.

The Dollar Index is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 66, suggesting the index might experience technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 105.40, 106.00

Support level:104.95, 104.45

Gold prices surged to near-record highs, propelled by a downbeat US Producer Prices Index, which heightened expectations of Federal Reserve rate cuts and bolstered the allure of the safe-haven asset amidst geopolitical tensions. US President Joe Biden’s pledge of unwavering support to Israel amid escalating tensions with Iran further fueled investor appetite for gold as a hedge against geopolitical risks and inflationary pressures.

Gold prices are trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 80, suggesting the commodity might enter overbought territory.

Resistance level: 2400.00, 2420.00

Support level: 2385.00, 2375.00

The Australian dollar faced pressure from deteriorating economic prospects in China, its key trading partner. Chinese inflation figures for March fell below expectations, adding to concerns about economic growth. Meanwhile, the Reserve Bank of Australia (RBA) reiterated its commitment to current monetary policy in its March meeting minutes. Futures for the RBA cash rate suggest an expectation of approximately 50 basis points of policy rate cuts in 2024, with the first cut potentially occurring in December.

AUD/USD is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 42, suggesting the pair might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 0.6585, 0.6640

Support level: 0.6500, 0.6445

The Euro faced significant downward pressure following the European Central Bank’s dovish stance on monetary policy, signalling an imminent interest rate cut amid stagnant economic growth. While the ECB maintained its interest rate unchanged, President Christine Lagarde’s announcement of considering rate cuts in June, coupled with the bank’s cautious language, weighed heavily on the Euro. The ECB’s shift in language and acknowledgment of downside risks underscored the need for accommodative measures to spur economic recovery.

EUR/USD is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 30, suggesting the pair might enter oversold territory.

Resistance level: 1.0775, 1.0870

Support level: 1.0710, 1.0655

The Japanese yen continued to hover around record lows against the US dollar as investors monitored the potential for currency intervention from the Bank of Japan. Japanese Finance Minister Shunichi Suzuki emphasised the authorities’ readiness to address excessive exchange-rate swings, signalling the possibility of intervention to stabilise currency movements. Uncertainty persists regarding the timing of such interventions, prompting investors to closely monitor developments for trading cues.

USD/JPY is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 69, suggesting the pair might enter overbought territory.

Resistance level: 153.10, 154.75

Support level: 151.95, 150.80

The US equity market edged higher as US Treasury yields retraced following the release of a downbeat inflation report, complicating the Federal Reserve’s interest rate outlook. The US Producer Prices Index rose by a slightly lower-than-expected 0.20% in March, dampening investor expectations for a June rate cut after consumer inflation data for the same period surpassed forecasts. Market sentiment shifted, with the likelihood of a June rate cut now seen at only 24%, down significantly from 61.1% the previous week.

The Dow is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 38, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 39150.00, 39855.00

Support level: 37700.00, 36560.00

Crude oil prices maintained a positive trajectory amidst heightened tensions in the Middle East, with Iran vowing retaliation for a suspected Israeli air strike on its embassy in Syria. The potential for supply disruptions from the oil-producing region supported oil prices, although gains were tempered by a pessimistic economic outlook following the European Central Bank’s downgraded economic prospects.

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 57, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 87.90, 90.80

Support level: 85.35, 83.05

تداول العملات الأجنبية والمؤشرات والمعادن والمزيد في فروق أسعار منخفضة على مستوى الصناعة وتنفيذ سريع للغاية.

قم بالتسجيل للحصول على حساب PU Prime Live من خلال عمليتنا الخالية من المتاعب

قم بتمويل حسابك بسهولة من خلال مجموعة واسعة من القنوات والعملات

الوصول إلى مئات الأدوات في ظل ظروف تداول رائدة في السوق

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!