Market Summary

The global financial markets are facing heightened uncertainty following the Trump administration’s decision to impose tariffs on Canada, Mexico, and China. The situation escalated further as China announced retaliatory tariffs on U.S. imports yesterday, raising concerns of a potential trade war between the world’s two largest economies. This development has sent ripples across global markets, with investors seeking refuge in safe-haven assets.

Gold, a traditional safe-haven, continues its upward trajectory, sustaining above the $2,900 mark as risk aversion dominates market sentiment. Conversely, oil prices are under pressure as demand concerns mount in the wake of the tariff measures from both the U.S. and China, casting a shadow over the energy market.

In the forex market, the U.S. dollar is trading with downside pressure, prompting investors to shift their focus to other major currencies. The euro gained momentum following a better-than-expected unemployment report from the Eurozone, which came in below market consensus. Meanwhile, the Australian dollar strengthened after the Reserve Bank of Australia (RBA) signaled a more hawkish stance and the country’s GDP data exceeded market expectations, bolstering confidence in the currency.

Equity markets are also feeling the impact of the trade tensions. Wall Street continues to face headwinds as the uncertainty surrounding tariffs threatens to weigh on the U.S. economy. In contrast, Chinese equities, including Hong Kong’s Hang Seng Index, opened higher today, buoyed by the Chinese government’s firm stance in countering the U.S. tariff measures.

Current rate hike bets on 19th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95%) VS -25 bps (5%)

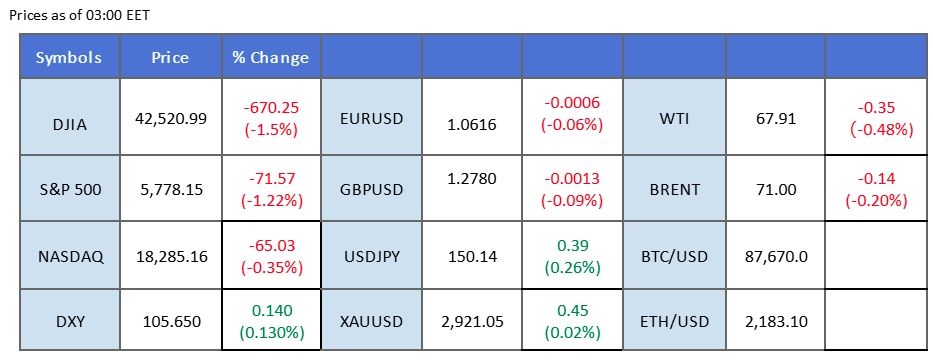

Market Overview

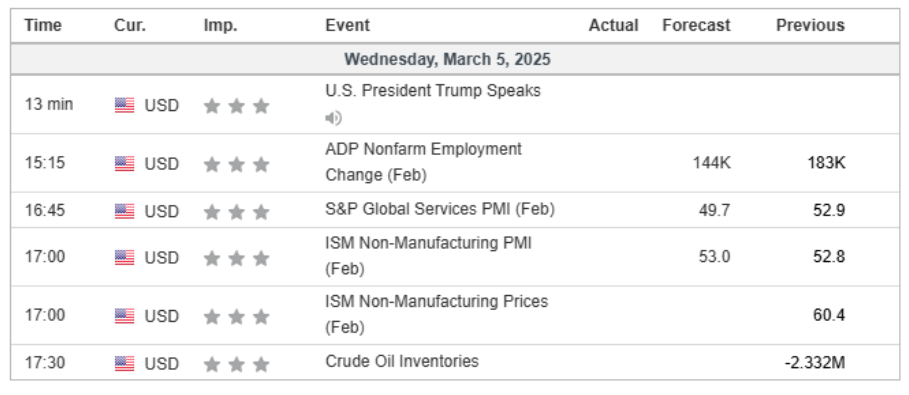

Economic Calendar

(MT4 System Time)

Source: MQL5

Market Movements

The dollar index extended its decline as investor sentiment improved following unexpected developments in the Russia-Ukraine conflict. Ukrainian President Zelenskiy signaled a willingness to pursue a peaceful resolution, a shift that came after U.S. President Trump paused military aid to Ukraine. In addition, Zelenskiy expressed interest in a natural resource agreement with the U.S., though he continued to push for security guarantees. As geopolitical tensions appeared to ease, investors reduced exposure to the safe-haven dollar, favoring risk-sensitive currencies such as the British pound and the euro.

The Dollar Index is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 30, suggesting the index might enter oversold territory.

Resistance level: 106.40, 107.60

Support level: 105.45, 104.45

Gold prices continue their bullish momentum as escalating trade tensions between the U.S. and China fuel uncertainty in global markets, driving demand for safe-haven assets. With President Trump set to speak today and China concluding its two-day parliamentary meeting, investors are bracing for potential policy announcements that could further escalate the situation. Any signs of heightened tensions or retaliatory measures from either side may push gold prices even higher as market participants seek refuge from volatility.

Gold prices have rebounded sharply from their recent low level but face strong resistance at the near $2920 mark. A break above this level would be a solid bullish signal for gold. The RSI is poised to break into the overbought zone, while the MACD is about to cross above the zero line, suggesting that the bearish momentum is vanishing.

Resistance level: 2920.00, 2950.00

Support level: 2875.50, 2835.00

GBP/USD surged to a three-month high in the last session, reinforcing a bullish outlook for the pair. The move was largely fueled by a weaker U.S. dollar, as markets reacted negatively to President Trump’s aggressive tariff measures against multiple trade partners, raising concerns over potential economic slowdowns and increased Fed dovishness. Meanwhile, geopolitical developments provided additional support for the Pound. The UK leadership, alongside European allies, is intensifying diplomatic efforts to mediate the ongoing Russia-Ukraine conflict, a move that, if successful, could bolster market confidence and further strengthen Sterling.

The pair has been trading in a higher-high price pattern, suggesting a bullish bias for the pair. The RSI has gotten into the overbought zone while the MACD is now diverging after breaking above the zero line, suggesting that the bullish momentum is gaining.

Resistance level: 1.2865, 1.2955

Support level: 1.2665, 1.2570

EUR/USD has climbed approximately 2% since the start of the week, signaling a bullish bias for the pair. The euro’s strength was underpinned by growing optimism over diplomatic efforts to resolve the prolonged Russia-Ukraine conflict, which has eased geopolitical uncertainty in the region. Additionally, the euro found further support from stronger-than-expected economic data. The eurozone unemployment rate, released yesterday, came in lower than market expectations, reinforcing confidence in the region’s labor market and economic resilience.

The USD/JPY has declined to its recent low levels. A break below the short-term support level at 148.85 should be seen as a bearish signal for the pair. The RSI has eased while the MACD is hovering near the zero line, with both indicators giving a neutral signal for the pair.

Resistance level:1.0650, 1.0705

Support level: 1.0600, 1.0525

Despite the slightly improved risk sentiment, the Dow Jones struggled to gain traction as investors remained cautious. Earlier optimism surrounding AI-driven growth has waned, with concerns mounting over its long-term sustainability. Meanwhile, lingering geopolitical uncertainties continue to weigh on market confidence, leaving equities vulnerable to further volatility.

The Dow is trading lower while currently near the support level. MACD has illustrated increasing bearish momentum, while RSI is at 34, suggesting the Dow might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 43400.00, 44335.00

Support level: 41900.00, 39990.00

The AUD/USD pair has broken out of its recent price consolidation range, signaling a bullish bias for the pair. The move was primarily driven by stronger-than-expected Australian GDP data released today, which indicated that the country’s economic growth is holding up better than anticipated, providing a boost to the Aussie dollar. Meanwhile, China’s government set an annual GDP growth target of 5% following the conclusion of its parliamentary meeting in Beijing yesterday. Given Australia’s strong trade ties with China, this optimistic growth outlook has further supported the Aussie dollar, reinforcing its bullish momentum.

The AUD/USD has been trading sideways in the recent session but has broken above the sideway range, suggesting a bullish bias for the pair. The RSI has rebounded from the overbought zone, while the MACD has a golden cross at the bottom, suggesting that the bearish momentum is easing.

Resistance level: 0.6300, 0.6370

Support level: 0.6200, 0.6115

Crude oil prices retreated amid progress in U.S.-Iran nuclear negotiations and renewed Russia-Ukraine ceasefire discussions. Hopes for a diplomatic breakthrough raised the possibility of sanction relief for Iran, potentially increasing global oil supply and putting downward pressure on prices. However, failure in talks could lead to tighter restrictions on Iranian exports, offering a counterbalance to supply concerns.

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 46, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 68.30, 69.30

Support level: 66.75, 65.50

تداول العملات الأجنبية والمؤشرات والمعادن والمزيد في فروق أسعار منخفضة على مستوى الصناعة وتنفيذ سريع للغاية.

قم بالتسجيل للحصول على حساب PU Prime Live من خلال عمليتنا الخالية من المتاعب

قم بتمويل حسابك بسهولة من خلال مجموعة واسعة من القنوات والعملات

الوصول إلى مئات الأدوات في ظل ظروف تداول رائدة في السوق

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!