Market Summary

Markets reacted sharply to Donald Trump’s tariff announcement, with risk-off sentiment dominating the session. The U.S. president-elect confirmed that tariffs on Canada and Mexico will take effect on March 4, alongside an additional 10% levy on all Chinese imports. The U.S. dollar surged on the back of Trump’s protectionist stance, with the Dollar Index (DXY) gaining nearly 0.8% in the last session. Meanwhile, the Canadian dollar weakened significantly, driving USD/CAD to its recent high with a weekly gain of over 1.5%.

The prospect of escalating trade tensions weighed heavily on risk assets. Wall Street ended lower, led by a sharp 500-point drop in the Nasdaq, while the Hang Seng Index also opened more than 500 points lower as investors priced in heightened uncertainty.

The crypto market was not spared from the broader risk aversion, with Bitcoin sliding to a fresh multi-month low of $80,000, its weakest level since last November. The recent Bybit hack has further eroded confidence in the digital asset space, triggering a wave of selling pressure.

Looking ahead, all eyes are on today’s U.S. PCE reading. A stronger-than-expected inflation print could further boost the dollar while intensifying pressure on risk assets, including equities and cryptocurrencies.

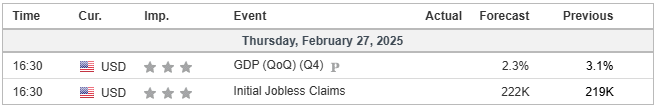

Current rate hike bets on 19th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95%) VS -25 bps (5%)

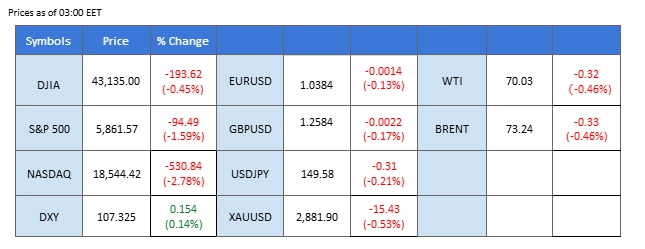

Market Overview

(MT4 System Time)

Source: MQL5

Market Movements

The Dollar Index surged sharply in the last session, breaking above its previous high and signaling a potential bullish trend reversal. The greenback gained momentum following Donald Trump’s announcement on planned tariff measures, set to take effect on March 4. The administration’s decision to impose a 25% tariff on Canadian and Mexican imports, along with an additional 10% levy on Chinese goods, fueled demand for the dollar as investors braced for heightened trade tensions.

The Dollar Index has broken above from the previous FVG level, signalling an end to the bearish trend. The RSI is poised to break into the overbought zone while the MACD is about to cross above the zero line, suggesting that the momentum is shifting to the bullish side.

Resistance level:108.40, 109.80

Support level: 106.50, 105.45

The strengthening of the U.S. dollar in the last session has pressured gold prices, keeping them near recent lows. Traders are closely watching the immediate support level at $2,875—should gold break below this level, it could signal a stronger bearish trend. However, with risk-off sentiment mounting in the broader market, gold may find support in the near term. The uncertainty surrounding trade tensions and geopolitical risks could drive safe-haven demand, potentially leading to a technical rebound for the metal.

Gold prices continue to slide in the last session, suggesting a bearish bias for gold. The RSI is edging lower while the MACD diverges after breaking below the zero line, suggesting that the bearish momentum remains strong with the gold.

Resistance level: 2920.00, 2955.00

Support level: 2834.40, 2800.00

The tech-heavy Nasdaq index suffered a sharp decline of over 500 points in the last session, marking its worst single-day drop of 2025. Investor sentiment deteriorated following a wave of risk aversion triggered by aggressive policy shifts from the Trump administration. The announcement of sweeping tariff measures stoked fears of escalating trade conflicts and potential economic disruptions, leading to a broad sell-off across equities.

Nasdaq is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum. However, RSI is at 22, suggesting the index might enter oversold territory.

Resistance level: 21910.00, 22560.00

Support level: 20510.00, 19360.00

The USD/CAD surged significantly in yesterday’s session as markets reacted to Donald Trump’s tariff announcement. The U.S. president set March 4 as the date for planned tariffs on Canada, a move that the market perceives as a major headwind for the already fragile Canadian dollar. Additionally, the U.S. dollar strengthened following Trump’s remarks, further fueling the pair’s upward momentum. With ongoing trade concerns and a stronger greenback, USD/CAD may continue to trend higher in the near term.

The USD/CAD pair reached a new high in the recent session, suggesting a bullish bias for the pair. The RSI has gotten into the overbought zone, while the MACD continues to edge higher, suggesting that the bullish momentum is gaining.

Resistance level:1.4550, 1.4660

Support level: 1.4340, 1.4240

The Hang Seng Index fell after President Trump confirmed an additional 10% tax on Chinese imports, further intensifying trade tensions. Chinese shares listed in Hong Kong dropped as much as 1.2%, reflecting growing investor concerns over the economic impact of escalating tariffs. This latest move comes on top of an earlier 10% duty, exacerbating fears over China’s struggling economy, which is already grappling with a property crisis and deflationary pressures. The renewed trade frictions also threaten to derail the optimism surrounding China’s AI sector, which had recently provided a glimmer of hope for a market rebound.

HK50 is trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 65, suggesting the Hang Seng Index might edge lower since the RSI retreated from overbought territory.

Resistance level: 23390.00, 24910.00

Support level: 21320.00, 18945.00

The biggest market-moving event yesterday was Trump’s confirmation that a 25% tariff on Canada and Mexico will take effect on March 4, alongside an additional 10% tax on Chinese imports. These developments have sent ripples across multiple asset classes, including forex markets. The AUD/USD pair has fallen nearly 2% this week after reaching its highest level in 2025. As a proxy for Chinese economic prospects, the Australian dollar remains under strong downside pressure amid concerns that new U.S. trade restrictions could weigh on China’s growth and overall risk sentiment.

AUD/USD is trading lower while currently near the support level. MACD has illustrated increasing bearish momentum. However, RSI is at 22, suggesting the pair might enter oversold territory.

Resistance level: 0.6295, 0.6365

Support level: 0.6200, 0.6115

Oil prices staged a technical rebound in the last session after consolidating near the $68.75 mark. The upside move was supported by stronger-than-expected U.S. GDP data, which lifted market sentiment and helped fuel a recovery in oil prices. Additionally, the latest weekly crude inventory report came in favor of oil, further boosting prices. However, despite the rebound, oil remains capped below its downtrend resistance level, signaling that it is still trading within a broader bearish trajectory. Unless a breakout occurs, the overall trend suggests further downside risks in the near term.

Oil prices gained more than 2% from their recent low levels, but oil remains trading within its bearish trajectory, suggesting a bearish bias for oil. The RSI rebounded, while the MACD has a golden cross at the bottom, suggesting a potential trend reversal for oil.

Resistance level:72.70, 75.00

Support level: 67.80, 65.60

تداول العملات الأجنبية والمؤشرات والمعادن والمزيد في فروق أسعار منخفضة على مستوى الصناعة وتنفيذ سريع للغاية.

قم بالتسجيل للحصول على حساب PU Prime Live من خلال عمليتنا الخالية من المتاعب

قم بتمويل حسابك بسهولة من خلال مجموعة واسعة من القنوات والعملات

الوصول إلى مئات الأدوات في ظل ظروف تداول رائدة في السوق

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!