*Both gold and the U.S. dollar gained as traders sought safety amid global political turmoil.

*U.S. political gridlock and fiscal concerns are fueling demand for defensive assets.

*Investors increasingly expect Fed rate cuts by year-end, but officials remain cautious.

Market Summary:

The U.S. Dollar Index (DXY) extended its rebound this week, climbing toward the 99 handle as investors sought refuge from mounting political instability abroad. The greenback’s strength has been largely externally driven, reflecting sharp weakness in the yen and euro. Japan’s new Prime Minister, Sanae Takaichi, signaled aggressive fiscal spending and dovish policy intentions, reviving yen carry trades, while France’s political upheaval following Prime Minister Sébastien Lecornu’s resignation further undermined the euro. In effect, the dollar has become the “cleanest dirty shirt” in a fragile global landscape.

At home, the picture is more uncertain. The ongoing government shutdown has created a data vacuum ahead of the Fed’s October meeting, leaving policymakers to navigate blind. The Federal Reserve remains split—New York Fed President John Williams favors cuts to support a softening labor market, while Governor Michael Barr warns against premature easing amid persistent tariff-driven inflation. Markets remain divided too, pricing in potential rate cuts later this year but wary that inflation and fiscal instability could delay any pivot.

Gold, meanwhile, has cooled from record highs above $4,050 per ounce as optimism over a U.S. brokered ceasefire between Israel and Hamas eased safe-haven demand. The stronger dollar and rising yields added further pressure, triggering a healthy correction after months of parabolic gains. Still, gold’s longer-term foundation remains firm, supported by relentless central bank buying which particularly from China and Poland and record ETF inflows, underscoring sustained global appetite for inflation and currency hedges.

In short, both assets are reflecting different sides of the same coin uncertainty. The dollar’s rebound is rooted in foreign weakness, while gold’s pullback marks consolidation within a broader bullish trend. As the Fed grapples with limited data and internal division, and geopolitical calm gradually returns, the tug-of-war between the dollar’s defensive appeal and gold’s structural strength will remain a central theme in global markets.

Technical Analysis

The U.S. Dollar Index has extended its recovery, breaking decisively above the descending trendline resistance and now consolidating near the 99.60 level. The breakout confirms a bullish reversal structure, reinforced by the index holding firmly above its 20- and 50-period moving averages, both trending higher.

Momentum indicators remain supportive but nearing overbought territory. The RSI stands at 71, suggesting stretched conditions that may trigger brief consolidation before any further advance, while the MACD remains firmly in positive territory, signaling ongoing upside momentum.

Overall, the dollar’s technical bias stays bullish following the breakout above its multi-month trendline, though traders should watch for potential pauses near 99.60–100.25. Sustained strength above that range could confirm a broader bullish extension, especially if risk aversion continues to underpin safe-haven flows into the greenback.

Resistance levels: 99.60, 100.25

Support levels: 98.70, 98.15

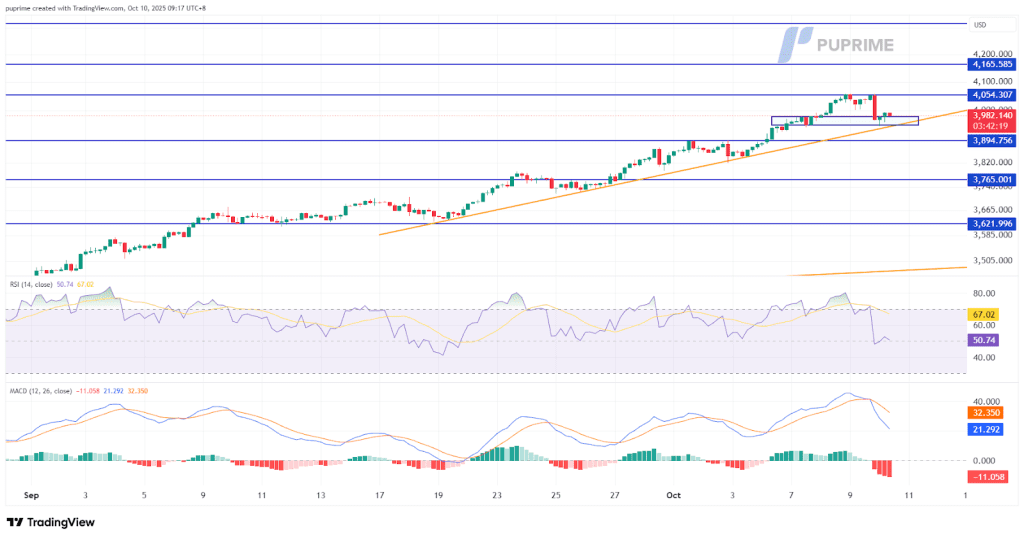

Gold (XAUUSD) has entered a corrective phase following its recent rally, with price action retreating from the $4,055 resistance and now testing a key ascending trendline support near the $3,895 zone. The pullback marks a loss of short-term momentum, though the broader structure remains constructive as long as the price holds above the confluence of support formed by the trendline and the prior consolidation base.

Momentum indicators, however, reflect a weakening technical posture. The Relative Strength Index (RSI) has slipped to near-neutral territory at 50, suggesting fading bullish pressure, while the MACD shows a bearish crossover with expanding negative histogram bars, pointing to a growing downside bias.

Overall, XAUUSD’s near-term bias has turned cautious within a still-upward trending framework. Maintaining support above $3,895 will be critical to preserving the broader bullish structure, while sustained weakness below this level could mark a shift toward corrective or bearish momentum in the sessions ahead.

Resistance levels: 4055.00, 4165.50

Support levels: 3895.00, 3765.00

تداول العملات الأجنبية والمؤشرات والمعادن والمزيد في فروق أسعار منخفضة على مستوى الصناعة وتنفيذ سريع للغاية.

قم بالتسجيل للحصول على حساب PU Prime Live من خلال عمليتنا الخالية من المتاعب

قم بتمويل حسابك بسهولة من خلال مجموعة واسعة من القنوات والعملات

الوصول إلى مئات الأدوات في ظل ظروف تداول رائدة في السوق

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!